- Member's menu

-

Close

Close - Home

- About pensions

- Your Nest pension

- Investing your pension

- Retirement

- Support

- Member's menu

-

Close

Close - Overview

- Take our three-step pension check

- What kind of retirement do you want?

- Calculate your retirement income

- How much should I save for my pension?

- How to grow your pension

- The advantage of saving early

- Why it's never too late to save

- How lifestyle changes affect your savings

- Member's menu

-

Close

Close

- Support

- Help centre

- Contact us

- Employer's menu

-

Close

Close - Home

- About workplace pensions

- Why choose Nest

- Setting up with Nest

- Managing your duties

- Support

- Employer's menu

-

Close

Close

- Support

- Help centre

- Contact us

Choose your

contribution rates

We make it easy to understand the minimum contribution levels and what terms like qualifying earnings and tax relief mean.

Knowing more about contributions will help you understand your duties and to put the right processes in place.

Choosing how much to contribute

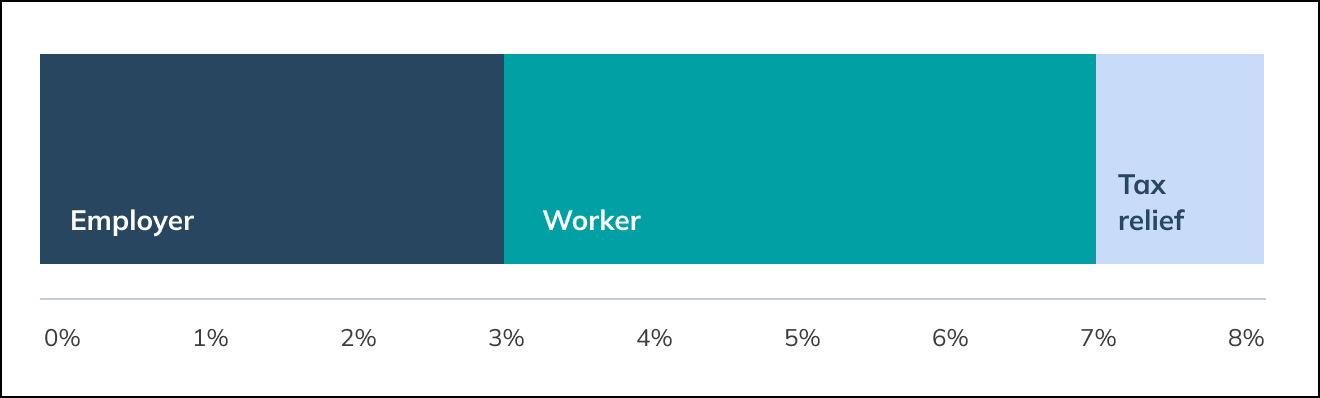

The legal minimum contribution for eligible workers is 8% of their qualifying earnings. You have to pay at least 3% of this. If you do pay the minimum, the worker must contribute the rest to make this up to at least 8%. This means the worker will have to pay at least 5%.

If they’re eligible, workers will get tax relief from the government on their contribution. It’s one way the government encourages workers to save for their future.

You and your workers can choose to pay more if you want to, and we cover this in more detail below.

Tax relief

You should deduct employee contributions from their net pay on a relief at source (RAS) basis. This means if a worker’s eligible for tax relief their contribution can be deducted from their pay after tax and National Insurance, and net of basic rate tax relief which is 20%.

For every £1 of contribution you deduct, you take 80p from their net pay and we reclaim 20p from the government and add it to their pot.

So, if a worker’s contribution is 5%, their actual contribution will be made up of:

- 4% from their pay – this is what you send us

- 1% tax relief – this is what we claim from the government

If a worker pays higher or additional rate tax, they can claim further tax relief through their tax return.

We can help you understand more about RAS and how to calculate tax relief.

*Percentage of qualifying earnings

Qualifying earnings

Lots of employers use a worker’s qualifying earnings to calculate contributions. It’s the standard way to calculate the legal minimum contributions.

Qualifying earnings are a range – for the 2025/26 tax year, this is gross earnings between £6,240 and £50,270. You use a worker’s earnings between this range as a basis for calculating contributions.

For example, if a worker earns £20,000 a year, their qualifying earnings would be £13,760 as that’s how much of their earnings are between the range.

Every time you pay a worker you’ll need to work out their qualifying earnings for that pay period. There may be pay periods when workers don’t earn enough to qualify for a minimum contribution.

What do qualifying earnings include?

The following types of pay need to be included in qualifying earnings calculations:

- salary or wages

- overtime

- bonuses

- commission

- statutory sick pay

- statutory paternity, maternity or any other kind of family leave

- adoption pay

- holiday pay

You can find more information about calculating qualifying earnings in our help centre.

Using a different type of earnings

You don’t have to use qualifying earnings as a basis for calculating contributions. Your business may prefer to use workers’ basic pay or total pay, for example.

Under auto enrolment legislation, you can choose from different tiers to calculate minimum contributions. You can also use your own basis if it meets the legal requirements. If you do use one of these options, you’ll need to complete a certification. It’s easy to choose the earnings basis that you want to use in your online Nest account.

What is salary sacrifice?

Salary sacrifice, sometimes called salary exchange, is a tax-efficient way for you to make contributions to your workplace pension. Your employees agree to give up part of their salary in return for pension contributions and both you and your employees pay lower National Insurance contributions.

You can learn more about different types of earnings and certification in our help centre.

Common contribution questions

This useful information will help you understand more about contributions.

What workers do I have to make contributions for?

You have to pay contributions for the eligible jobholders you’ve auto enrolled and for any non-eligible jobholders who’ve opted into Nest.

Can I pay more than the minimum?

Yes, you can choose to pay more if you want to. You could pay your workers’ contribution for them or pay an additional amount on top of your minimum contribution, for example.

This could help you attract and keep good workers in your business, and help them build a bigger pot for retirement. If you do want to pay more, it’s easy to set this up in your Nest account.

Where can I get help?

Your payroll software may be able to automatically calculate contributions for you. If you’re using a third-party administrator (TPA), they will be able to support you too. You’ll also find a section in our help centre about managing contributions, and you can get in touch if you have any questions.