- Member's menu

-

Close

Close - Home

- About pensions

- Your Nest pension

- Investing your pension

- Retirement

- Support

- Member's menu

-

Close

Close - Overview

- Take our three-step pension check

- What kind of retirement do you want?

- Calculate your retirement income

- How much should I save for my pension?

- How to grow your pension

- The advantage of saving early

- Why it's never too late to save

- How lifestyle changes affect your savings

- Member's menu

-

Close

Close

- Support

- Help centre

- Contact us

How inflation impacts your savings

The idea of investing your money can feel confusing, risky, or not right for you. The simple truth is that you already risk losing money if you keep your savings in a bank or a building society for long periods of time because it gets chipped away by inflation.

Our main goal is to make money for you over and above the inflation rate, without you needing to lift a finger.

How inflation could halve your spending power

Inflation is the rate at which the price of everyday goods and services change over time – things like food, electricity and petrol.

In the real world, these prices tend to go up each year. The Bank of England aims to keep the UK inflation rate at around 2% each year, although it can increase more than this. That’s where you’d see prices growing quickly and bills getting more expensive.

Will your pension rise with inflation?

Inflation doesn’t just impact your savings year-on-year. It affects how much you can afford in the future, known as your spending power.

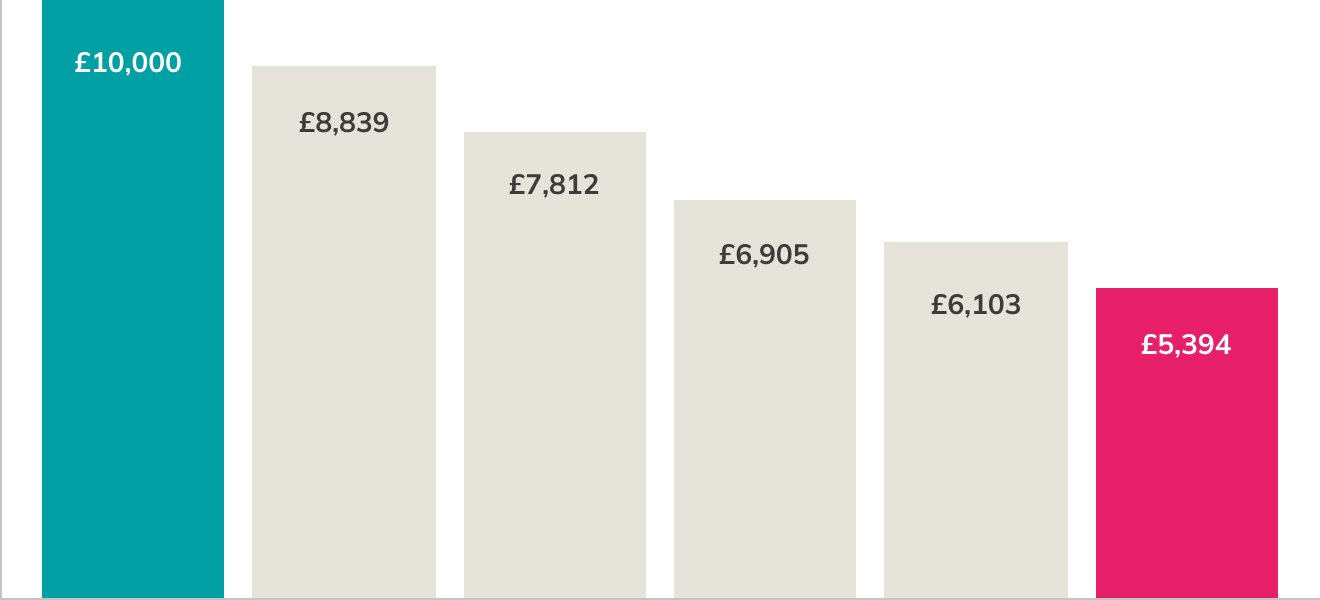

Imagine that you put a £10,000 rainy day fund under your mattress. If inflation rises at a rate of 2.5% each year, that £10,000 would buy increasingly fewer goods or services as time goes by. Your £10,000 purchasing power could drop to the equivalent of just £7,812 in ten years’ time. If you decided to use your rainy day fund in 25 years’ time, your £10,000 would buy you the equivalent of what you’d get for £5,394 today. Inflation would have halved your money’s purchasing power.

The impact of inflation over 25 years

Pensions vs banks and interest rates

Unfortunately, high street banks and other savings accounts don’t tend to offer enough interest to beat inflation.

That’s where Nest comes in.

We want you to have your hard-earned money when you’ll need it the most. We invest your money, working to grow it more than the rate of inflation. Our aim is for you to be able to afford the same standard of life in your future.

The bulk of our default investment strategy aims to add at least an additional 3% to your savings, after inflation and all fees are accounted for. We believe that will help counteract the way inflation chips away at your purchasing power. So if you had £10,000 saved with us, we aim to boost that to £38,134 over 25 years – and that’s without you topping up your pot.

That’s more than you’d get from saving into a bank account. And certainly more than keeping your money under the mattress.