- Member's menu

-

Close

Close - Home

- About pensions

- Your Nest pension

- Investing your pension

- Retirement

- Support

- Member's menu

-

Close

Close - Overview

- Take our three-step pension check

- What kind of retirement do you want?

- Calculate your retirement income

- How much should I save for my pension?

- How to grow your pension

- The advantage of saving early

- Why it's never too late to save

- How lifestyle changes affect your savings

- Member's menu

-

Close

Close

- Support

- Help centre

- Contact us

Pensions and other investments

Paying into a workplace pension is a great way to save for your future and can fit perfectly around your current investments.

Getting the right balance

A workplace pension doesn't have to replace any of the other ways you might already use to manage your money. It can work seamlessly alongside different financial commitments, whether that's an ISA, a property investment or a savings account.

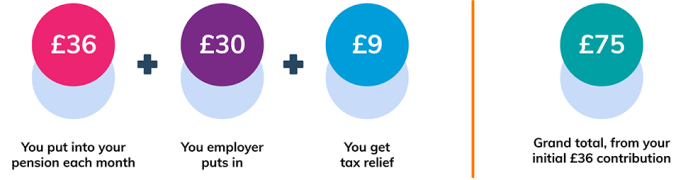

In fact, a workplace pension can be one of the most effective ways to save thanks to employer contributions, tax relief and from the long-term effect of having any investment returns on your savings reinvested. These help grow your pension pot over time and increase your retirement income beyond any State Pension that may be available.

Building up more money than you personally contribute is just one of the many reasons to save with a workplace pension. A small number of people may not be eligible for employer contributions or tax relief. If you're unsure, check with your employer.