- Member's menu

-

Close

Close - Home

- About pensions

- Your Nest pension

- Investing your pension

- Retirement

- Support

- Member's menu

-

Close

Close - Overview

- Take our three-step pension check

- What kind of retirement do you want?

- Calculate your retirement income

- How much should I save for my pension?

- How to grow your pension

- The advantage of saving early

- Why it's never too late to save

- How lifestyle changes affect your savings

- Member's menu

-

Close

Close

- Support

- Help centre

- Contact us

Nest Guided Retirement Fund

Our research shows that most people like the security of a regular income, but don’t want to be tied into one option.

Nest Guided Retirement Fund

If you’re in this fund, you can take money out regularly. We’ll continue to manage your pot with the aim of reducing the risk of it running out.

Who is this option for?

You can choose this option if you're aged between 60 and 70 and have at least £10,000 in your pot. If you don’t tell us what you want to do with your pot at your intended retirement date and you meet the criteria above, in most cases we'll automatically move your pot into this fund. If your pot is less than £10,000, you can consider paying more money into it. You could also look into whether you have any other suitable pots that could be transferred into Nest to reach the £10,000 minimum.

How does it work?

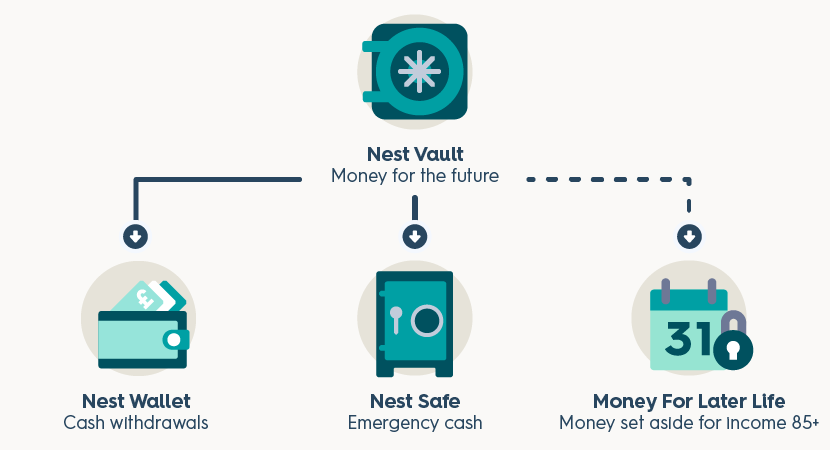

We'll split your pot into parts — each are designed and invested differently to meet different needs throughout your retirement.

Money in your Nest Wallet is available for you to withdraw to help with everyday expenses, regular bills or spend in any way you wish. Every year up until you're 85, Nest will move money from your Nest Vault into your Wallet.

This part of your pot is designed to provide money for future years' withdrawals, with some being moved into your Nest Wallet each year.

Nest will also put some money from the vault into a 'later life pot' each month once you turn 65. This pot is designed to provide you with money to buy a guaranteed lifetime income from age 85 if you wish.

This part of your pot is designed to help you pay for emergencies, unexpected events or possibly the odd treat. Nest will put a one-off amount of money into your Nest Safe when your pot is moved into the Nest Guided Retirement Fund.

For more details on how each part of the fund works, read this factsheet on the Nest Guided Retirement Fund.

What are the benefits?

Consistency

Nest aims to make available a stable and sustainable level of money which you can withdraw until age 85, leaving a separate pot that can be used to purchase a guaranteed income for life. This should reduce the risk of your pot running out.

Easy access

You can make withdrawals online via the Nest website and have them paid directly to your bank account.

Flexibility

You can take your pot in full, or choose a different retirement option, at any time if your circumstances change.

Support

Nest will continue to manage your pot and invest your money with the aim of providing sustainable withdrawals.

Frequently asked questions

If you haven’t told us what you want to do with your pot at your intended retirement date, and you're aged between 60 and 70 with at least £10,000 in your pot, in most cases we'll automatically move you into this fund.

We can't provide you with advice about whether the Nest Guided Retirement Fund is right for you. You can find out more yourself by downloading this factsheet, which may help you make up your mind. It’s a good idea to seek professional guidance or advice before making your decision. You may be able to get free guidance from the Pension Wise service from MoneyHelper or use a financial adviser. Details of independent financial advisers can be found at unbiased.co.uk. Nest won’t be responsible for any fees you may be charged for this advice.

If you're not ready to retire and want to continue to save, you can change your nominated retirement date so it's in line with your plans. Your money will then be put into the Nest Retirement Date that matches the year you plan on withdrawing your money. You can also switch to a different fund. If you do want to retire and you don’t think it’s right for you, you can choose another retirement option.

You can take money out by logging into your Nest account. To find out more, go to How do I take money out of the Nest Guided Retirement Fund?

The fund is managed by Nest's investment team. The team invests each part differently with the overall aim being to provide you with a sustainable amount of money to withdraw each year. The amount allocated to each part of the Nest Guided Retirement Fund is based on, among other things, investment performance, your age, and when you join the fund. Nest's investment team reviews the fund strategy and how each part is invested every year to try and ensure they're kept on track.

Usually 25% of each withdrawal will be tax free with the remaining 75% being taxed at your marginal tax rate. Nest will use your tax code - where we have it - to deduct the tax, if necessary, before making a payment. Where we don't have your tax code, the emergency tax rate will be used in line with HMRC guidance.

If you're making withdrawals and continuing to pay contributions, you may also be liable to an additional tax charge if contributions exceed £4,000 per year.

In these circumstances the remaining fund will usually be paid to your nominated beneficiaries, if you have made a nomination, or at the discretion of the trustee, if you have made an expression of wish. If you haven’t made a nomination or an expression of wish, benefits will usually be paid to your estate. Find out more about your options.

Nest factsheet

To learn more about the Nest Guided Retirement Fund, download this factsheet.

Talk things through

Need someone to talk to for independent guidance?