- Member's menu

-

Close

Close - Home

- About pensions

- Your Nest pension

- Investing your pension

- Retirement

- Support

- Member's menu

-

Close

Close - Overview

- Take our three-step pension check

- What kind of retirement do you want?

- Calculate your retirement income

- How much should I save for my pension?

- How to grow your pension

- The advantage of saving early

- Why it's never too late to save

- How lifestyle changes affect your savings

- Member's menu

-

Close

Close

- Support

- Help centre

- Contact us

New research finds savers want pensions with strong environmental and social credentials

Published: 05 October 2018

- 73 per cent of savers want their pensions invested responsibly

- 51 per cent of women say this matters a lot, compared with 43 per cent of men

- Strong environmental and social credentials can help improve low levels of trust and engagement among pension savers

- 63 per cent of savers want to hear more about it from their pension scheme

Millions of savers who’ve been auto enrolled into pensions expect their money to be invested responsibly, new research finds today.

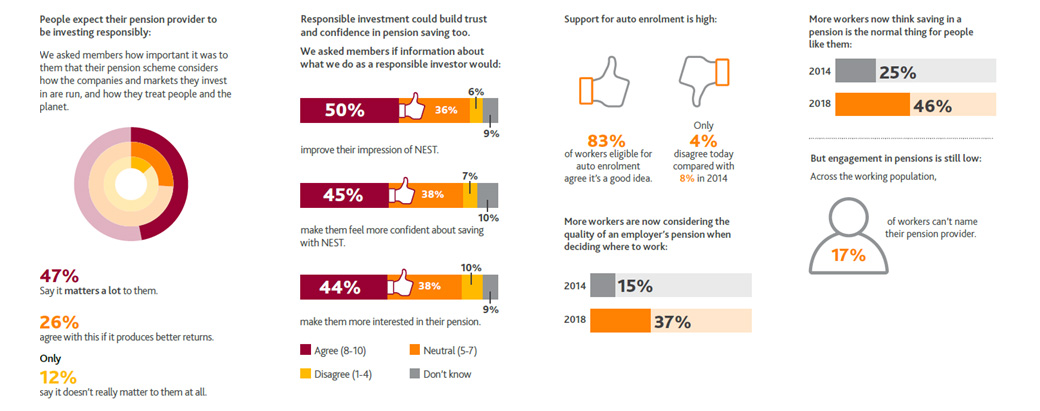

Survey data shows nearly two thirds of NEST savers (73 per cent) think it’s important their pension scheme considers the environment, society and corporate behaviour when investing their money. Nearly half (47 per cent) said this mattered a lot to them, whereas just one in ten (12 per cent) didn’t cite it as a key concern. Women are even more likely than men to want their pension scheme to take account of people and the planet when making investment decisions on their behalf.

NEST commissioned this research to better understand and engage with the new generation of savers created by the government’s automatic workplace pension policy. It found that only around a quarter of workers (28 per cent) trust pension companies, with a similar proportion (25 per cent) saying they don’t. But hearing about how their pension is invested responsibly led to higher levels of trust, interest and confidence among savers*. Around two thirds of NEST members (63 per cent) also wanted to hear more about this aspect of their pension.

Following the results, NEST will continue to invest member savings, which already total nearly £4bn across more than 7m workers, to achieve good pension outcomes by considering the wider impact of corporate behaviour on people and the planet.

For example, NEST developed a climate aware fund and has invested £624m into it since February 2017. Over the year these investments have avoided carbon emissions equivalent to taking 27,239 cars off the road each year, stopping 14,524 tonnes of waste going to landfill or powering 6,248 homes for a year.

Commenting on the findings, Diandra Soobiah, Head of Responsible Investment at NEST, said:

‘A potential £495bn** will flow into workplace pensions over the next twelve years, making workers more powerful shareholders with a major stake in how companies and markets are run. They’re telling us they want this money invested responsibly, which could improve the environment and society they’ll live and retire in as well as their future bank balances.

‘Hearing savers on this issue is a win-win. A more responsible approach to investing can boost long term financial returns, build a better, more sustainable future, and has the added benefit of being something about pensions that might genuinely excite people.

‘The green shoots of a strong pension saving culture are beginning to show in the UK, but people still mistrust the pensions industry. Investing thoughtfully and responsibly could clearly go a long way to building the trust and confidence still needed to help that culture flourish.’

Secretary of State for Work and Pensions, Esther McVey said:

“Since 2010 the pensions industry has transformed. In the last six years almost 10 million people have automatically enrolled into a pension scheme, and the number of members of an occupational pension scheme has increased by almost 50%, up to 41.1 million in 2017.

“And these savers, particularly new younger savers, are wanting a say in where they put their money. Technology, transparency and the new changes we have introduced make it easier to do that by accessing information about the nature and sustainability of investments.

“We are putting power back in the hands of individuals, giving them the ability to see where their money is going and choose what investments they want to back. Increasingly people are looking to support companies whose values align with theirs, environmentally and socially, giving them a say and a stake in a future world.”

Although trust in the industry is low, NEST’s research suggests pension saving is becoming an established part of British culture. Support for automatic enrolment is at an all-time-high (83 per cent) and the number of people disagreeing with the workplace pension policy has halved since 2014 from 8 to 4 per cent. Nearly twice as many people now consider their employer’s pension when deciding where to work (37 per cent compared to 15 per cent in 2014). And nearly twice as many workers think pension saving is normal for people like them (46 per cent compared to 25 per cent in 2014).

The new survey data is published in NEST’s annual responsible investment report, which looks at how members’ money has been invested responsibly throughout the year.

Other highlights from the report include:

- NEST’s climate aware investment approach has seen £133.3m withdrawn from companies that are high contributors to climate change and invested instead in businesses set to benefit from the transition to a low carbon economy.

- Winners include renewables and green technology companies like Iberdrola, EDP Renovaveis SA, Vestas Wind Systems and Siemens Gamesa Renewable Energy.

- Companies losing out on investment are generally energy giants that are still focused on fossil fuel extraction strategies, like ExxonMobil and Royal Dutch Shell.

- NEST has invested in a commodities fund that excludes tobacco, uranium, thermal coal and palm oil.

- NEST’s global developed equities fund manager voted against company management 2,825 times over the year and supported 30 per cent more shareholder resolutions than the previous year.

Notes to editors:

For more information, contact Annie Bruzzone on annie.bruzzone@nestcorporation.org.uk or 020 3056 3657.

About the research:

NEST regularly conducts research with our membership and the wider population eligible for auto enrolment. All survey results are weighted to be in line with the relevant population. Data in this press release is drawn from:

- NEST member survey conducted online in November 2017 with 3543 members. Results are weighted to reflect NEST membership by age and gender.

- NEST member survey conducted online in September 2017 with 5481 members. Results are weighted to reflect NEST membership by age and gender.

- NEST consumer survey conducted online in November 2017 with 1030 individuals working in the private or third sector and eligible for automatic enrolment. Results are weighted to be reflective of this population.

Please see full report for further details.

** Pensions Policy Institute, 2014, How will automatic enrolment affect pension saving?