- Member's menu

-

Close

Close - Home

- About pensions

- Your Nest pension

- Investing your pension

- Retirement

- Support

- Member's menu

-

Close

Close - Overview

- Take our three-step pension check

- What kind of retirement do you want?

- Calculate your retirement income

- How much should I save for my pension?

- How to grow your pension

- The advantage of saving early

- Why it's never too late to save

- How lifestyle changes affect your savings

- Member's menu

-

Close

Close

- Support

- Help centre

- Contact us

Contributions and fees

Paying into a Nest pension means you’re investing in your future. As we’re a workplace pension, your employer and the government will top up your pot every time you contribute, if you’re eligible. Getting this extra money on top of your contributions is one of the best things about pensions.

We invest all the money that’s held in your pot, working to grow it over time. Like all pension providers, we charge a small fee for this.

What gets paid into your pot?

Most members pay a percentage of their wages that’s been set by their employer, although you may have had the option to set this yourself depending on what type of member you are. You or a third party can top this up further.

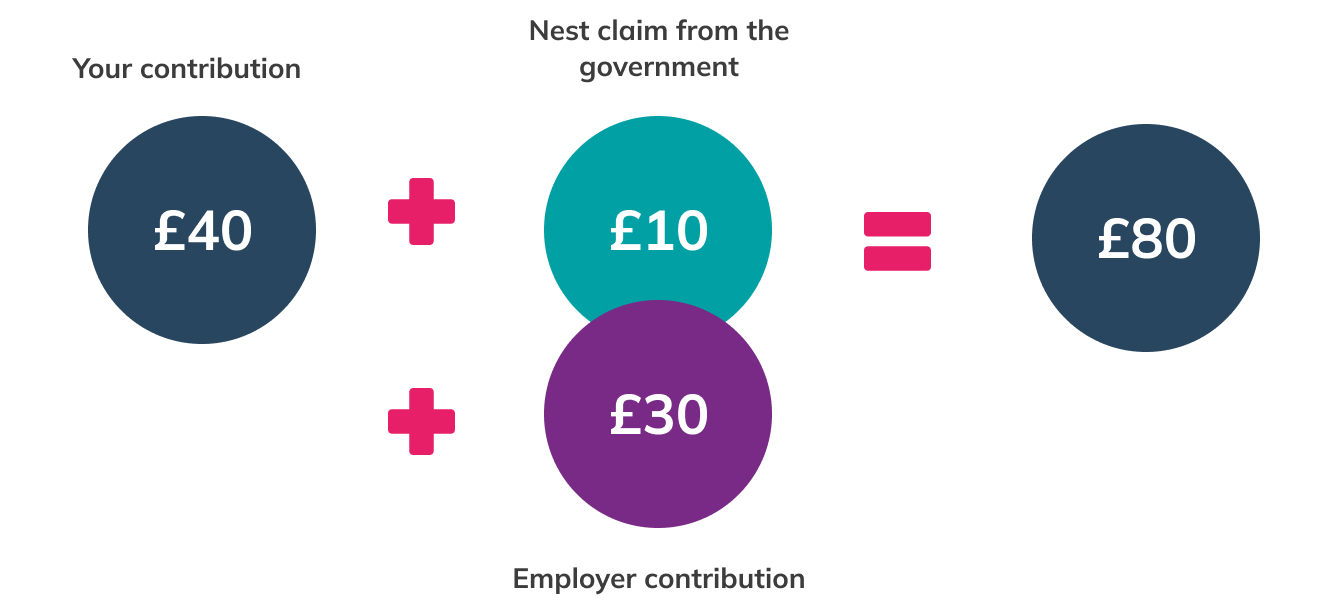

If you get tax relief or contributions from your employer, this is a great way to boost your contributions. If you pay in £40, we’ll claim £10 from the government and add it to your pot – if you’re eligible. You could also get another £30 from your employer, boosting your initial £40 contribution up to £80. That’s £40 extra money saved towards a more comfortable retirement - and our investment performance could grow it even further.

These figures are based on minimum contribution levels. If your employer contributes more than the minimum, you’d get even more in your pension pot.

Your contributions

How much should I contribute?

There’s no set amount to save for the future. Just as with all life plans, it depends on you and your circumstances. The best thing to do is work backwards, figuring out how much yearly income you’ll want once you’ve stopped working and using that to see how much you’ll need to have set aside.

You can choose to pay more or less into your pot at any time. So if your current payments won’t add up to your chosen pension goal in time for your planned retirement, you can adjust how much you’re currently contributing.

Can I invest a lump sum into my pension?

There are three simple ways to pay more on top of the regular contributions you and your employer make into your pot:

- Save more through your employer: Ask your employer to take the extra money straight from your wages. This is an especially good option if your employer matches your contributions.

- Save regularly: Pay extra through a Direct Debit and avoid any ongoing payment admin.

- Save at your own pace: Make one-off contributions by Direct Debit or debit card. You can pay in as often or as little as you like, as long as you contribute £10 each time.

We invest all the money held in your pension pot, working to grow your savings for the future. You’ll see your additional contribution in your pot once it’s been invested.

What’s the minimum I can contribute?

The government have a legal minimum that you and your employer must collectively pay into your workplace pension, if you earn above a certain amount. It’s set to 8% of your qualifying earnings, which are the part of your salary that your contributions are calculated from. For the 2025/26 tax year, you’ll pay contributions on any earnings between £6,240 and £50,270. Some employers may use a different method to calculate contributions, so the exact amount you’ll pay can vary from company to company.

Your employee contribution is 5% of your qualifying earnings. Most people will only pay around 4% of their take-home pay as they’ll get tax relief from the government every time they contribute.

There is no minimum contribution level if you’re self-employed or don’t reach the qualifying earnings threshold.

How are pension contributions calculated?

Your contributions, your employers’ contributions and tax relief are all taken into account when working out minimum contribution levels. Here’s what the government recommends for automatically enrolled workers.

Employers can choose a different way to calculate this, as long as at least 8% of your pay goes to your pension pot.

What’s the most I can put in?

The more you save, the more income you’ll have in the future, so it’s a good idea to save as much as you can afford.

You’re free to pay as much into your Nest pension pot as you’d like. However, you might have to pay additional tax if either of these situations apply:

- Your total pensions contributions from all sources goes over the annual allowance set by the government.

- You start taking money from one of your pots, reducing your annual allowance, and your pensions contributions from all sources goes over this lower allowance limit. This is known as the money purchase annual allowance.

Most members will never go over these limits, but it’s a good idea to be aware of them.

Should my employer be contributing to my pension?

There are certain rules around age and earnings that dictate whether your employer must contribute to your pension.

*This table is based on the auto enrolment and qualifying earnings level. These figures are reviewed annually by the government and may change each year.

How does working part-time affect my pension?

You shouldn’t be treated any differently to people doing the same job who work full-time, so it won’t affect your pension rights. You should be automatically enrolled into your workplace pension scheme if you’re eligible. However, as you’re likely to be earning less and contributing less into your pension pot, you may end up with less money when you stop working.

What fees do I pay?

We have the same low charges for all members. This stays the same whether a member is contributing or not, whatever fund they’re contributing to, and no matter how much is in their retirement pot.

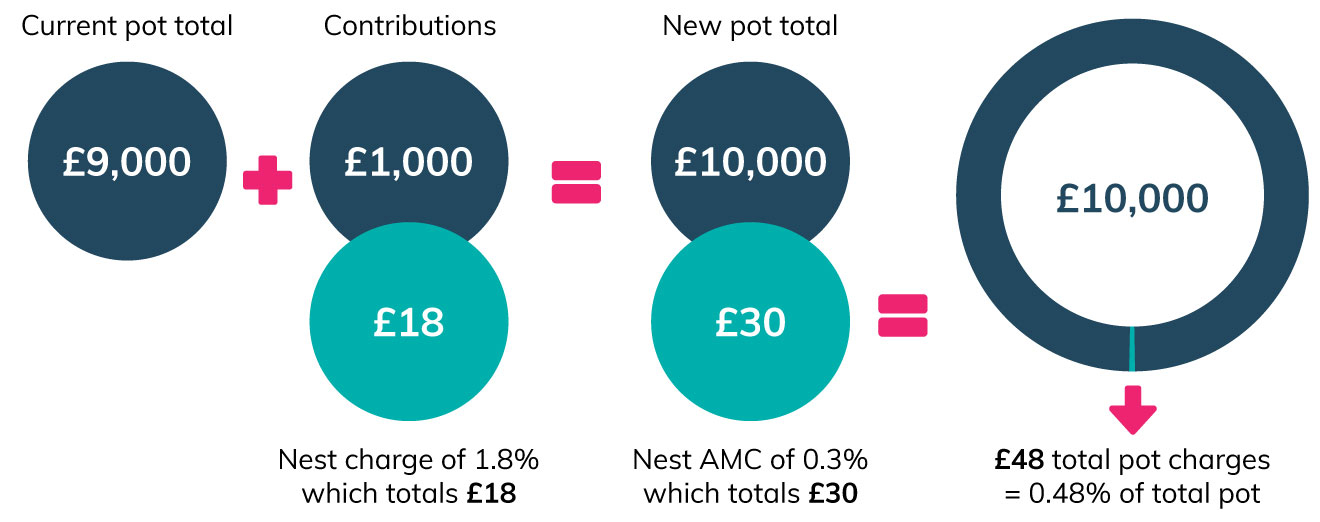

These charges are made up of two parts:

- a contribution charge of 1.8% on each new contribution into your pot

- an annual management charge (AMC) of 0.3% on the total value of your pot each year

So if you paid £1,000 into your pot over the year, your contribution charge would be £18. If your pot was then worth £10,000, you’d pay an AMC of £30.

The total charge would come to £48. That’s just under 0.5% of the total value of their retirement pot.

There are no hidden costs when you save with Nest - these two fees are all you pay. We don’t charge you for switching your fund, changing your retirement date, transferring your pot or any other services.

The money you pay covers everything that’s needed to manage your pension, including:

- the cost of administering members’ pension pots

- management fees for investing your money

- transaction costs

Ever wondered how much Nest’s fees will add up to over your lifetime? You can see the combined effect of the annual management charge, contribution charge and transaction costs over the years in our costs and charges booklet.

Transaction costs

All investors, including pension schemes, must pay a fee to buy and sell their investments. This fee is known as a transaction cost. We don’t charge for these separately, but they’re factored into the overall investment returns you’ll receive. If you want to learn about our investment policies and what our strategy is driven by, our Statement of Investment Principles offers more information.

Want to know what the transaction costs for your fund adds up to? Details for each of our default funds and fund choices can be found in our annual scheme report and accounts.

Making transfers into Nest

Contributions aren’t the only way to pay into your pot. You can also transfer other pension pots into and out of Nest. This means you can bring your pension pots together, making your savings easier to manage.

You won’t pay a contribution charge on any transfers into Nest. However, our 0.3% AMC is based on how much is in your pension pot, which includes any funds you’ve transferred in.

We don’t charge if you’re transferring money out of Nest, but it’s important to check if your new pension provider has fees.

Taking a break from your contributions

You can pause your contribution payments at any time. Don’t forget that stopping your contributions means you won’t get any top ups from the employer or the government, if you were receiving them.

Using my online account

Take stock of your savings, make extra contributions and change the way we’re investing your money by logging in to your online account.