- Member's menu

-

Close

Close - Home

- About pensions

- Your Nest pension

- Investing your pension

- Retirement

- Support

- Member's menu

-

Close

Close - Overview

- Take our three-step pension check

- What kind of retirement do you want?

- Calculate your retirement income

- How much should I save for my pension?

- How to grow your pension

- The advantage of saving early

- Why it's never too late to save

- How lifestyle changes affect your savings

- Member's menu

-

Close

Close

- Support

- Help centre

- Contact us

The advantage of

saving early

It's simple - the longer you save with a workplace pension, the more time your money could grow.

Why should I save earlier rather than later?

You'll have more time to benefit from a workplace pension like Nest by starting to save early. On top of your contributions, the added bonus is that if you're eligible you'll benefit from employer contributions and tax relief from the government too.

Watch the video to learn more:

Starting to save younger – how you could benefit

Saving early means your money is invested for longer and has more time to grow - and any returns your savings make is also reinvested and has a chance to grow too. Increasing your payments in the future may give you a better chance to improve your quality of life in retirement.

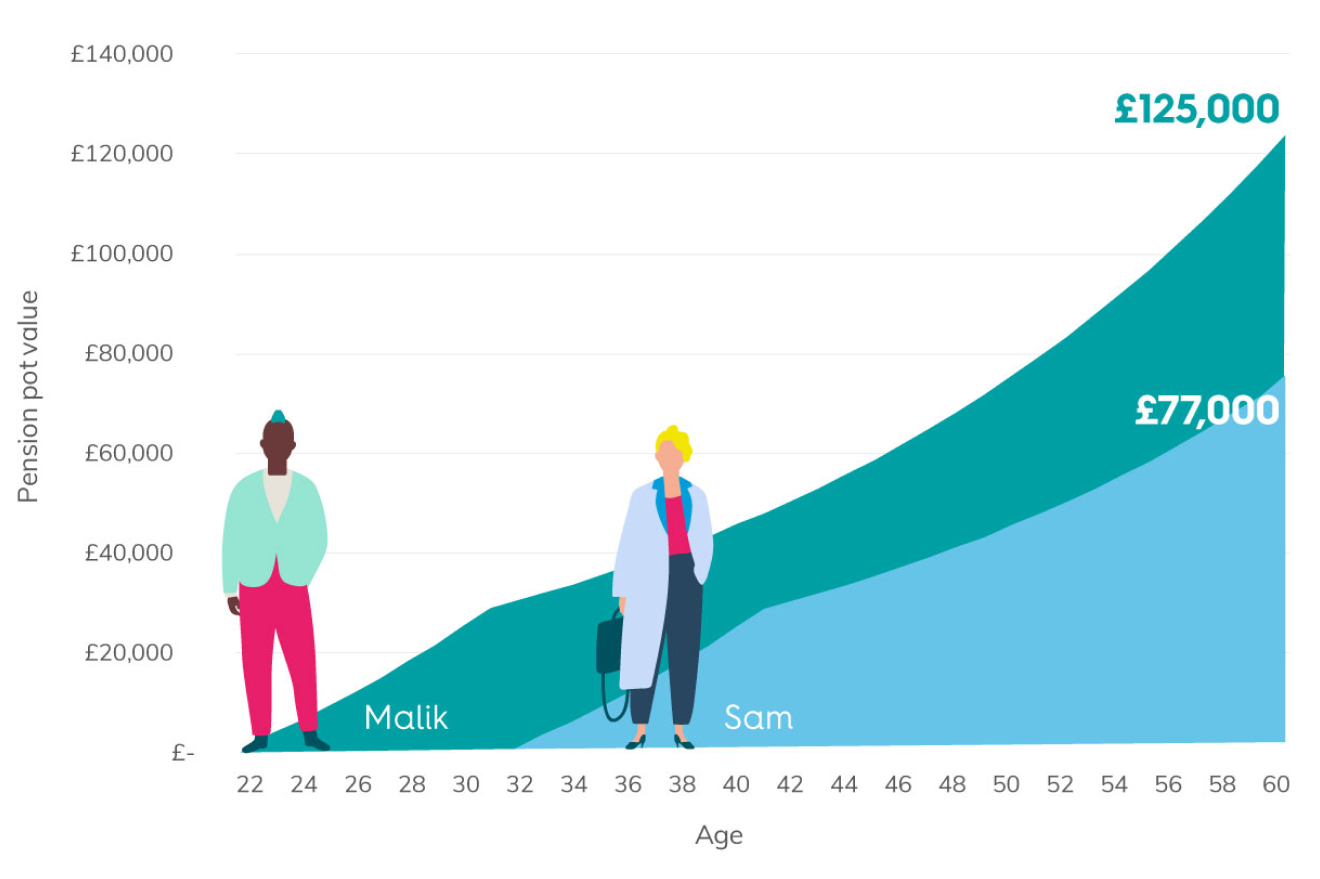

To make this clearer, we can use two Nest members, Malik and Sam, as an example. Let's say Malik and Sam each had monthly contributions including employer payments and tax relief totalling £200. These monthly contributions were paid into both of their Nest pots for 10 years, which adds up to £24,000 each. The only difference is that Malik made his contributions between the age of 22 and 32 while Sam made hers between 32 and 42.

Assuming we invested and grew their money by 5% every year until the age of 60, the results would be very different. Even though they paid in the same amount Malik would have nearly £125,000 but Sam would only have around £77,000. That's because by starting to save earlier, Malik gave his savings an extra 10 years to grow. The graph below helps to demonstrate this.

So, don't miss out. Make sure you're being savvy with your money by starting to save as early as you can.