What are the different types of contribution I can receive?

What are the different types of contributions?

- As a member of Nest, you have one retirement pot that you can carry on contributing to throughout your working life. Different types of contributions can be added to your pot at any time.

- Contributions can be made by you from your wages and your employer may also contribute. Your employer is responsible for paying this to us so that we can invest the money in your retirement pot.

- You can also make additional contributions if you want to either by a one-off payment or arranging to contribute a little more on a regular basis. You can do this by logging into your online account and setting up a payment. For more information, please see How can I make additional contributions?

- Anyone can contribute to someone else’s Nest retirement pot. This could be a parent or close relative. If someone would like to contribute to your retirement pot, they’ll just need to pay by debit card and tell us your Nest ID. To get more information about your Nest ID, please see What’s my Nest ID? To make a payment on behalf of a member go to Make a contribution area of our website.

- If you’re eligible for tax relief, we’ll collect tax relief on your contributions and add this to your retirement pot. We’ll claim tax relief on all member contributions paid by your employer, additional contributions and contributions made by someone else. We won’t claim tax relief on any transferred in amounts or employer contributions. To find out more about tax relief see Do I need to claim tax relief myself?

- Log in to your online account and your dashboard will display a summary of the contributions you have received.

- Any contributions made by you from your wages or any additional contributions will show under You.

- Additional contributions could be one-off payments, regular payments or transfers of other pensions to Nest.

- Contributions made by employers that have enrolled you in Nest will show under Your employer(s).

- Any tax relief contributions made by the government will show under Tax relief.

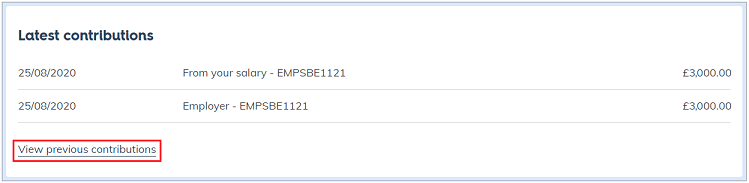

- If you’d like to see more information, click ‘View previous contributions’ in Latest contributions on your dashboard.

- You’ll be able to search for the details by using Search by date range or Choose a tax year option.

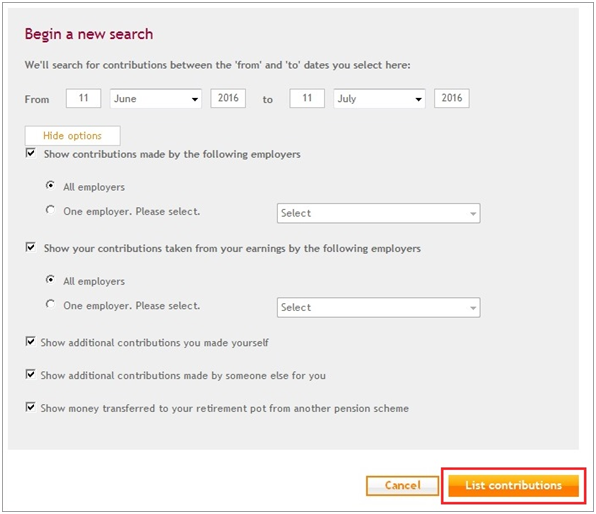

- This will allow you to search any contributions made by you or your employer in the previous tax years or depending on specific date range.

- If you want to look at all of your contributions for a set period of time, you can click ‘More options’ and filter for what you’re looking for.

- Click ‘List contributions’ when you’re ready to search.

We value your feedback

Your feedback is important to us. To help us improve, tell us what you think about our member help centre by taking a short survey.

Was this helpful to you?

Thank you.

Thank you.

Thank you for the feedback.

Feedback

Was this helpful to you?

Live Chat

Our live help agents will answer your questions and guide you through setting up and managing NEST.

Our chat is available from Monday to Sunday from 8.00AM to 8.00PM

Web chat is currently unavailable

We're open from 10.00 am until 4.00 pm today. Please try again between these hours or our usual business hours of 8am to 8pm Monday to Sunday. Or you can visit our online help centre.

Web chat is currently unavailable

Our offices are now closed for the Bank Holiday. You can reach us during our normal opening times of 8am to 8pm Monday to Sunday. Or you can visit our online help centre.

Welcome to live help

To help us deal with your question quickly please tell us who you are and what you'd like help with by choosing an option from each of the menus below:

Live chat

Live chat