How can I take some of my retirement pot as cash?

You may have two options for taking some of your retirement pot as cash while continuing to save with Nest:

- Self-managed option: read on for further details

- The Nest Guided Retirement Fund: you may be eligible to join this fund. For more information, visit Nest Guided Retirement Fund

- You have to be 55 or over. From April 2028, the minimum pension age will be 57.

- If you’ve got less than £3,000 in your pot, you can only take the full amount.

- If you have more than £3,000, you can make partial withdrawals.

- You can make only one withdrawal every calendar month.

- The minimum amount you can take at a time is £200, and you must leave a balance of at least £2,000 after each withdrawal.

- The quickest and easiest way to start making withdrawals is by logging in to your online account. Alternatively, you could call us on 0300 020 0090 to get started.

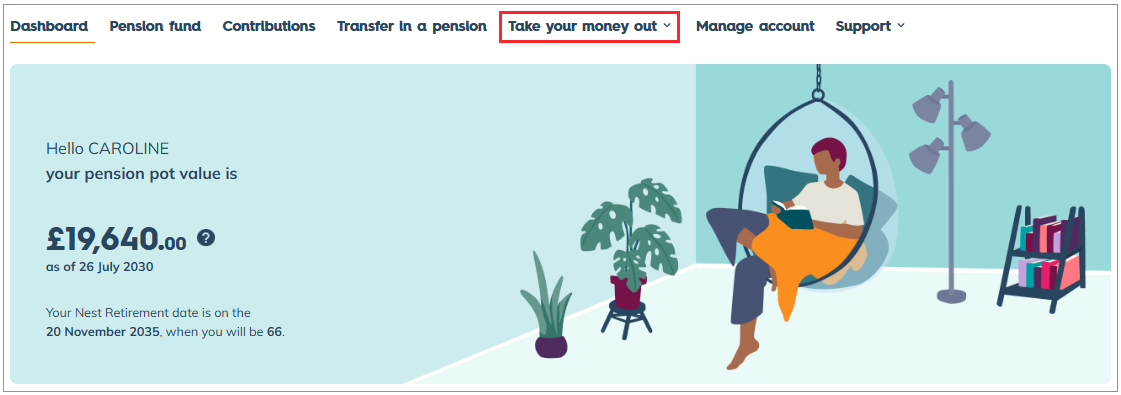

Screen by screen guide for taking some of your retirement pot as cash

Log in to your online account and select ‘Take your money out’ at the top of your dashboard.

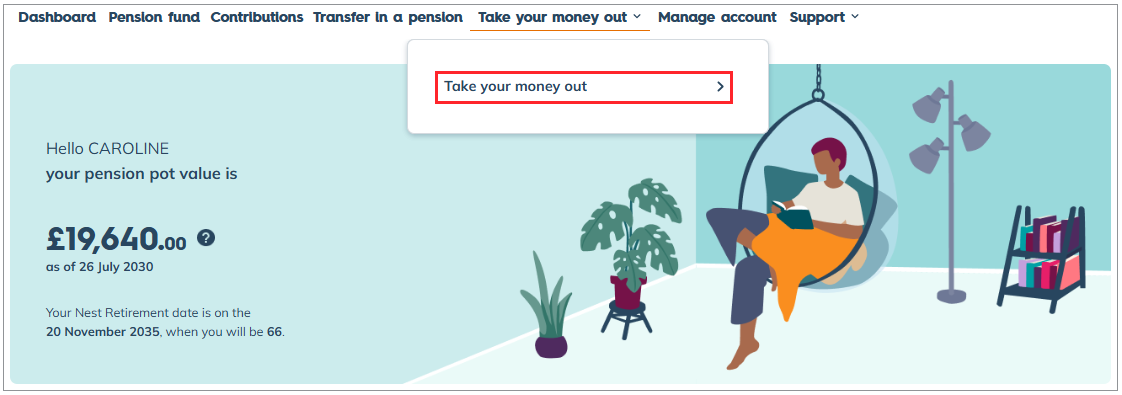

Then select ‘Take your money out’.

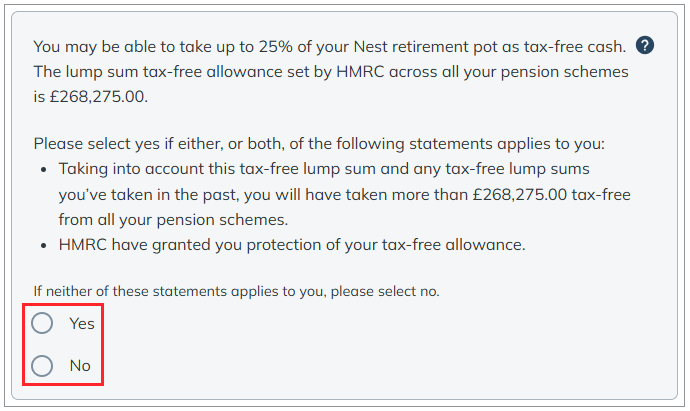

- You’ll be able to see your personal details we hold for you such as your name, address and NI number.

- Please check if these details are correct before continuing with taking your money out.

- To begin, you’ll need to confirm Yes or No to the statement underneath your details.

- Your answers will help us to calculate any income tax that might be payable on your requested withdrawal.

- If you’ve taken more than £268,275 as tax-free lump sum from all your pension schemes including the current withdrawal or if you’ve been granted protection of your tax-free allowance from HMRC, select the option Yes.

- If you confirm Yes, please follow the instructions and contact us by phone.

- If you confirm No, you can continue to view your retirement options.

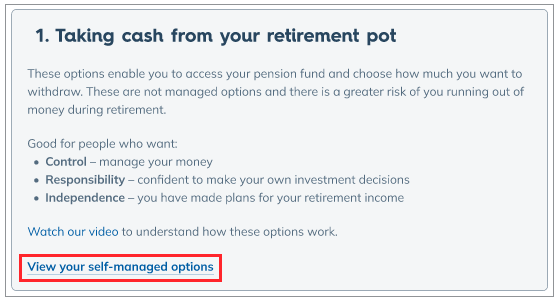

- Select ‘Your options for taking money out’ to view the options available for you.

- Then select ‘View your self-managed options’ to explore your cash withdrawal options.

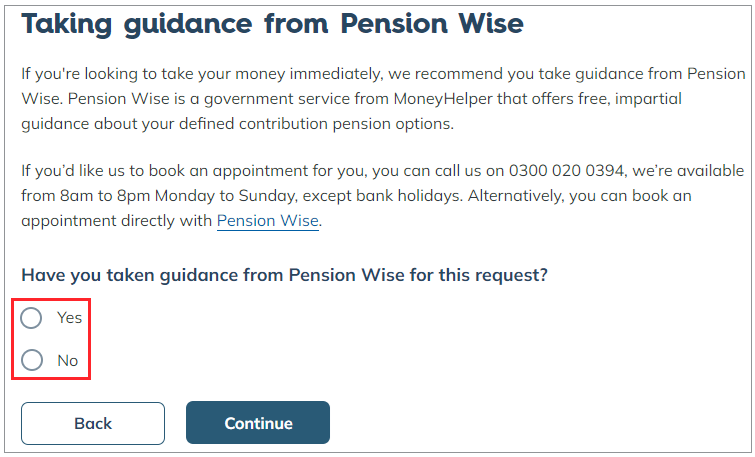

- If you’ve taken guidance from Pension Wise for this request, select ‘Yes’ and then select ‘Continue’.

- If you want us to book an appointment for you, please call us on 0300 020 0394 between 8am to 8pm, Monday to Sunday.

- You can also book an appointment directly on the Pension Wise website or by calling them on 0800 138 3944 between 8am to 8pm, Monday to Friday.

- If you do not wish to book an appointment, you can choose to opt-out of receiving guidance from Pension Wise.

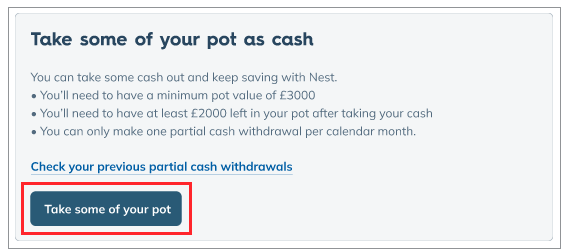

- Then select ‘Take some of your pot’.

- Enter the amount you want to withdraw and select ‘Calculate’. This will show you the estimated amount you’ll receive in your bank account after deducting tax.

- When you take withdrawals from your pot, 25% will usually be tax-free and the remaining 75% will be taxed as part of your income for the year when you get the money. You may also be impacted by the tax-free lump sum allowance of £268,275, this is the total amount you can withdraw tax-free across all your pension schemes. For more information please see Your pensions and tax.

- Select ‘Continue’ to proceed and confirm the bank account details.

We'll need your bank or building society account details. We can only make payment to a valid UK account that's held in your name.

If you've made a previous withdrawal from Nest, we'll show details of the account we paid to, for you to check. You can change these to a different account if you want to.

- Once you have submitted your request, to protect your Nest pot we send your details over a secure link to Experian to help check your identity. This won't affect your credit rating or any future credit searches.

- You should receive the payment within 5 – 10 working days once we’ve received the required information or if we don’t need any further details.

- Please make sure your personal details are kept up to date. If you include your mobile number, we'll text you with an update on your request.

- We’ll send you a P60 statement after the tax year is completed if you’ve taken some of your pot as cash.

- Your Nest account will stay open and you can continue to save with us.

- If you’ve taken some of your pot as cash and later claimed your full Nest retirement pot or transferred out before your P60 is issued at the end of the tax year, then we’ll send you both a P60 and a P45 statement.

- Once you’ve taken money from your Nest account you won’t be able to pay more than £10,000 into any defined contribution pension scheme each tax year without paying extra tax.

Sometimes we may need to ask you for proof of identification and/or bank account ownership to verify your request. This is to ensure your pot is protected and only the rightful owner gets access to the cash.

To avoid postal delays, please use your Nest mailbox to send documents to us electronically. We’ll accept copies of birth, or marriage certificates, but remember these are protected by Crown copyright. The General Register Office’s guidelines on the use of copies of official certificates is available for you to read.

To send us documents via your Nest mailbox:

- Log in to your Nest account and select ‘Messages’.

- Then select ‘Mailbox’ and then select ‘Compose email’.

- Enter the subject, message type and the text of your message in the Your message field.

Select ‘Add an attachment’ at the bottom of the message to upload your document. You can send up to three attachments in one email. Ensure each attachment file size does not exceed 5 MB. The total file size should not exceed 15 MB.

- If you have more attachments, you should send us multiple emails from your Nest mailbox.

- Don’t compress, zip the files or password protect it as we don’t accept these file types.

- Only .jpeg, .gif, .tiff, .doc, .docx, .xls, .xlsx and .pdf file types can be accepted.

- Once complete, select ‘Send’.

We value your feedback

Your feedback is important to us. To help us improve, tell us what you think about our member help centre by taking a short survey.

Was this helpful to you?

Thank you.

Thank you.

Thank you for the feedback.

Feedback

Was this helpful to you?

Live Chat

Our live help agents will answer your questions and guide you through setting up and managing NEST.

Our chat is available from Monday to Sunday from 8.00AM to 8.00PM

Web chat is currently unavailable

We're open from 10.00 am until 4.00 pm today. Please try again between these hours or our usual business hours of 8am to 8pm Monday to Sunday. Or you can visit our online help centre.

Web chat is currently unavailable

Our offices are now closed for the Bank Holiday. You can reach us during our normal opening times of 8am to 8pm Monday to Sunday. Or you can visit our online help centre.

Welcome to live help

To help us deal with your question quickly please tell us who you are and what you'd like help with by choosing an option from each of the menus below:

Live chat

Live chat