How do I take money out of the Nest Guided Retirement Fund?

- This article explains the guidelines around taking money out of the Nest Guided Retirement Fund.

- It tells you how to make cash withdrawals (screen by screen guide) from the different parts of your Nest Guided Retirement Fund.

- It explains what happens when you request a withdrawal.

- Please make sure your personal details are kept up to date. If you include your mobile number, we'll text you with an update on your request.

- The minimum amount you can withdraw from your Nest Wallet is £20, or the full amount if lower. You can make one withdrawal a month.

- You can make withdrawals from your Nest Safe at any time if funds are available.

- If you want to take money from your Nest Vault, you’ll either need to come out of the Nest Guided Retirement Fund and choose a different retirement option, or you can take all of your pot as cash.

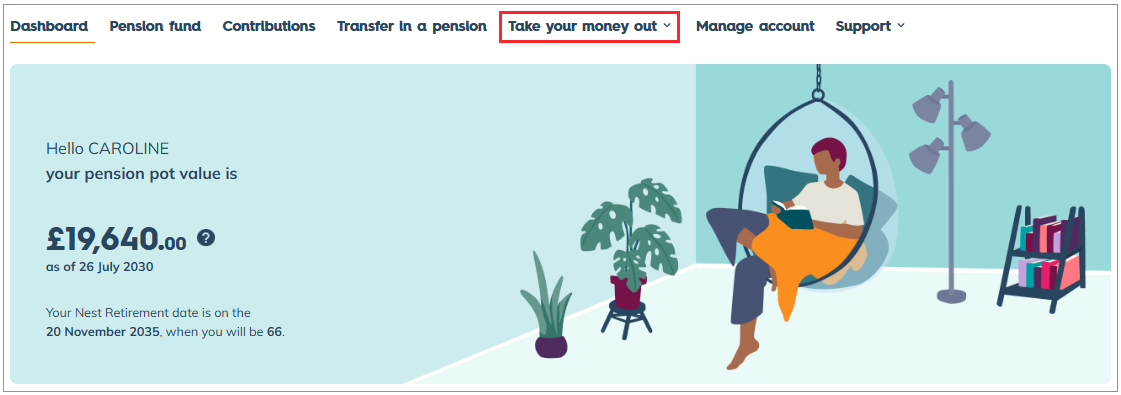

The quickest and easiest way to start making withdrawals is by logging in to your online account.

Select ‘Take your money out’ at the top of your dashboard.

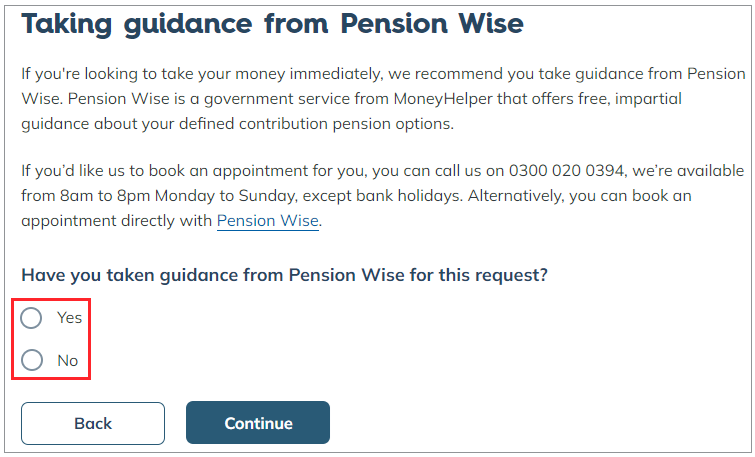

We recommend that you take guidance from Pension Wise which is a government service from MoneyHelper.

If you want us to book an appointment for you, please call us on 0300 020 0394 between 8am to 8pm, Monday to Sunday.

You can also book an appointment directly on the Pension Wise website or by calling them on 0800 138 3944 between 8am to 8pm, Monday to Friday.

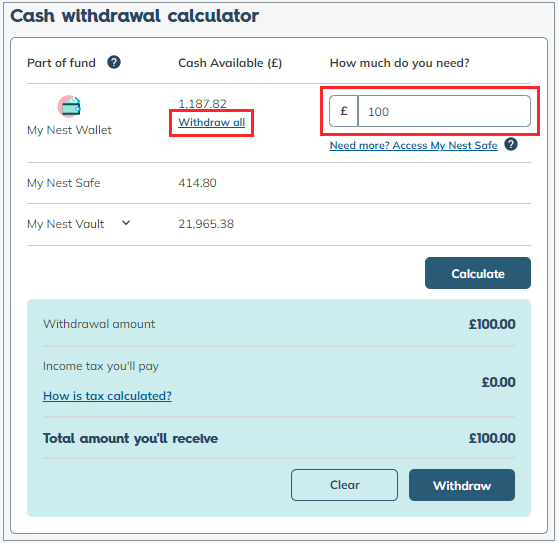

Taking cash from your Nest Wallet and/or your Nest Safe

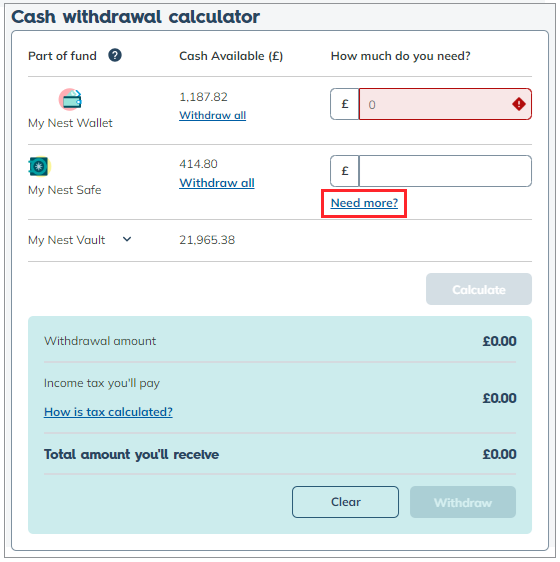

- Enter the amount you want to withdraw from your Nest Wallet or select ‘Withdraw all’.

- Then select ‘Calculate’ to show the estimated amount you’ll receive in your bank account after deducting tax.

When you take withdrawals from your pot, 25% will usually be tax-free and the remaining 75% will be taxed as part of your income for the year when you get the money. You may also be impacted by the tax-free lump sum allowance of £268,275, this is the total amount you can withdraw tax-free across all your pension schemes. For more information please see Your pensions and tax.

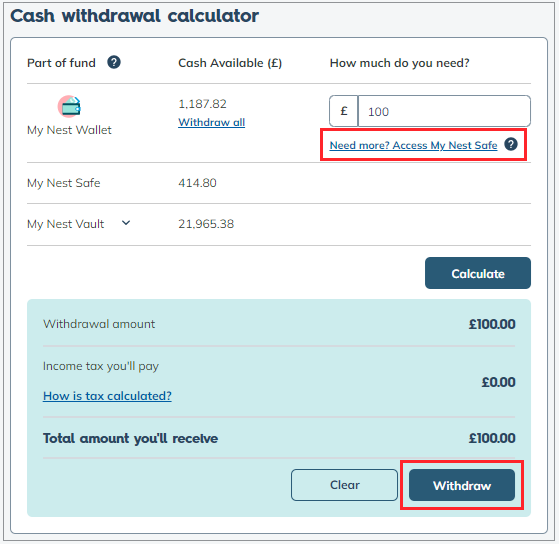

To take money from your Nest Safe, select ‘Need more? Access my Nest Safe’, then enter the amount you want to withdraw.

Select ‘Withdraw’ to enter your bank details.

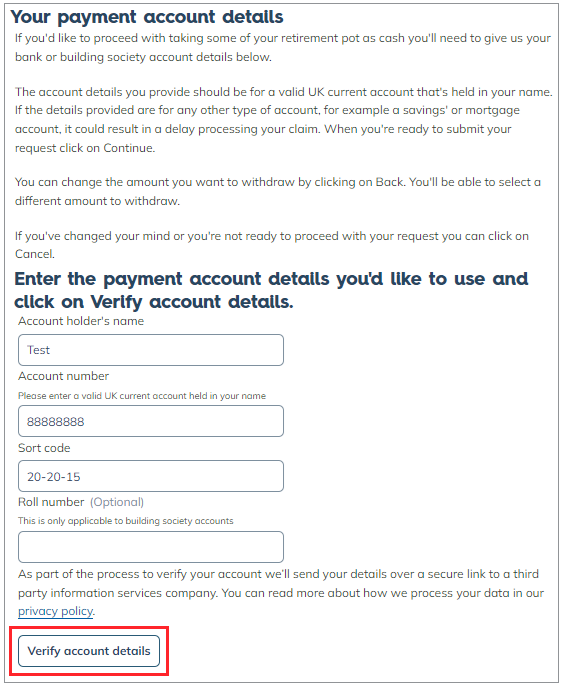

We'll need your bank or building society account details. We can only make payment to a valid UK account that's held in your name.

If you've made a previous withdrawal from Nest, we'll show details of the account we paid onscreen for you to check. You can change these to a different account if you want to.

- Once you have submitted your request, to protect your Nest pot we send your details over a secure link to Experian to help check your identity. This won't affect your credit rating or any future credit searches.

- You should receive the payment within 5 – 10 working days once we’ve received the required information or if we don’t need any further details.

- We’ll send you a P60 statement after the tax year is completed if you’ve taken some of your pot as cash.

- Your Nest account will stay open and you can continue to save with us.

- If you’ve taken some of your pot as cash and later claimed your full Nest retirement pot or transferred out before your P60 is issued at the end of the tax year, then we’ll send you both a P60 and a P45 statement.

- Once you’ve taken money from your Nest account you won’t be able to pay more than £10,000 in the current tax year into any defined contribution pension scheme without paying extra tax.

Sometimes we may need to ask you for proof of identification and/or bank account ownership to verify your request. This is also to ensure your pot is protected and only the rightful owner gets access to the cash.

You may want to choose another retirement option if:

- You no longer want to be in the Nest Guided Retirement Fund.

- You want to access money in your Nest Vault.

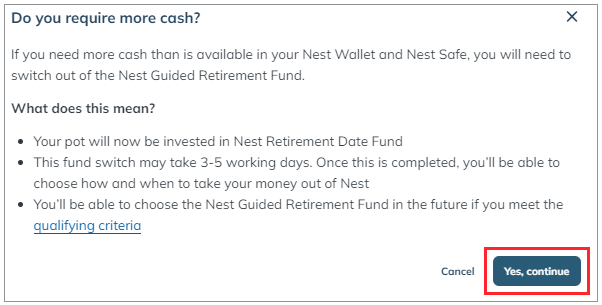

If you want to choose a different retirement option, select ‘Need more?’ next to your Nest Safe.

You’ll then be asked to confirm your decision. If you want to do this, select ‘Yes, continue’.

You’ll then be taken to a screen showing your other options.

We value your feedback

Your feedback is important to us. To help us improve, tell us what you think about our member help centre by taking a short survey.

Was this helpful to you?

Thank you.

Thank you.

Thank you for the feedback.

Feedback

Was this helpful to you?

Live Chat

Our live help agents will answer your questions and guide you through setting up and managing NEST.

Our chat is available from Monday to Sunday from 8.00AM to 8.00PM

Web chat is currently unavailable

We're open from 10.00 am until 4.00 pm today. Please try again between these hours or our usual business hours of 8am to 8pm Monday to Sunday. Or you can visit our online help centre.

Web chat is currently unavailable

Our offices are now closed for the Bank Holiday. You can reach us during our normal opening times of 8am to 8pm Monday to Sunday. Or you can visit our online help centre.

Welcome to live help

To help us deal with your question quickly please tell us who you are and what you'd like help with by choosing an option from each of the menus below:

Live chat

Live chat