How do I set up salary sacrifice for employees on Nest?

Salary sacrifice or salary exchange is an arrangement where an employee gives up part of their salary and in return the employer pays it into their pension pot as an employer contribution. Please see the MoneyHelper website to understand if this is the right option for you and your employee. If you plan to use a salary sacrifice arrangement, we recommend that you take independent financial advice.

Within your existing Nest account you will need to create a Nest Group for the employees who are in this arrangement. You may have employees in the Nest pension scheme who are not part of the salary sacrifice arrangement – i.e. you will continue to deduct contributions from their pay. Our instructions below will give you one Nest Group for the employees in the salary sacrifice arrangement and another for those that are not. All the employees will appear on the same contribution schedule each pay period.

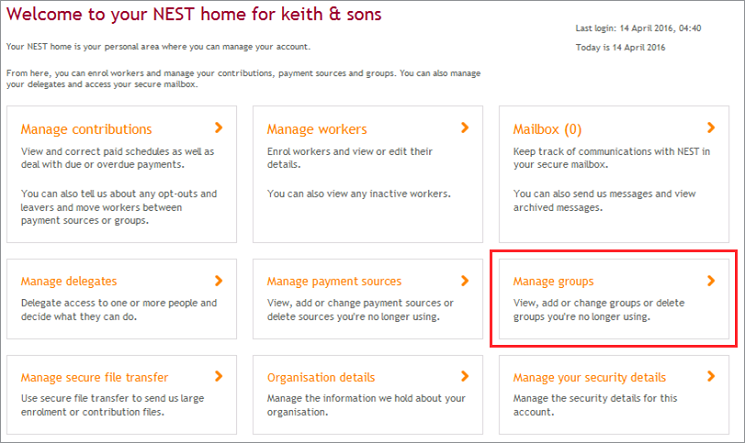

Click on ‘Manage groups’ on your Nest home page.

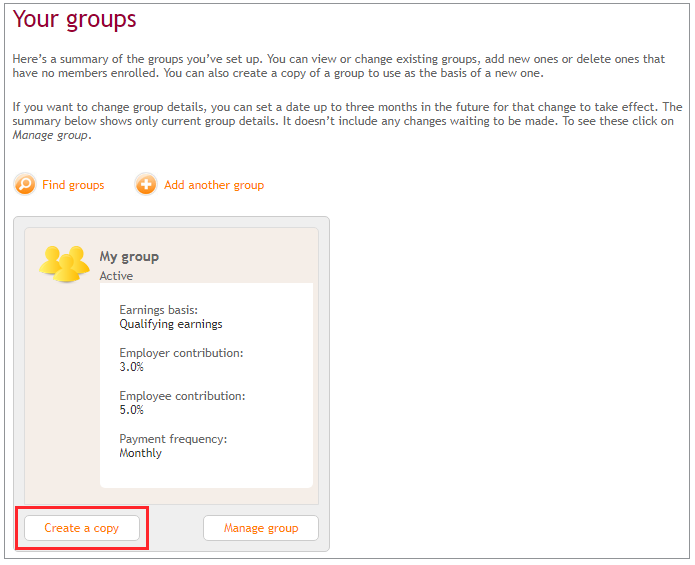

Click ‘Create a copy’.

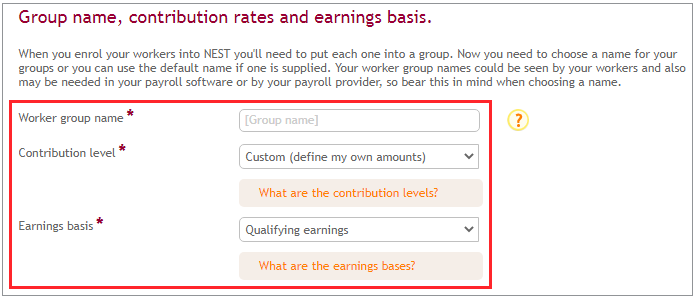

You’ll need to name the new group. From the drop down of Contribution level select ‘Custom (define my own amounts)’ and you may keep the Earnings basis as it is.

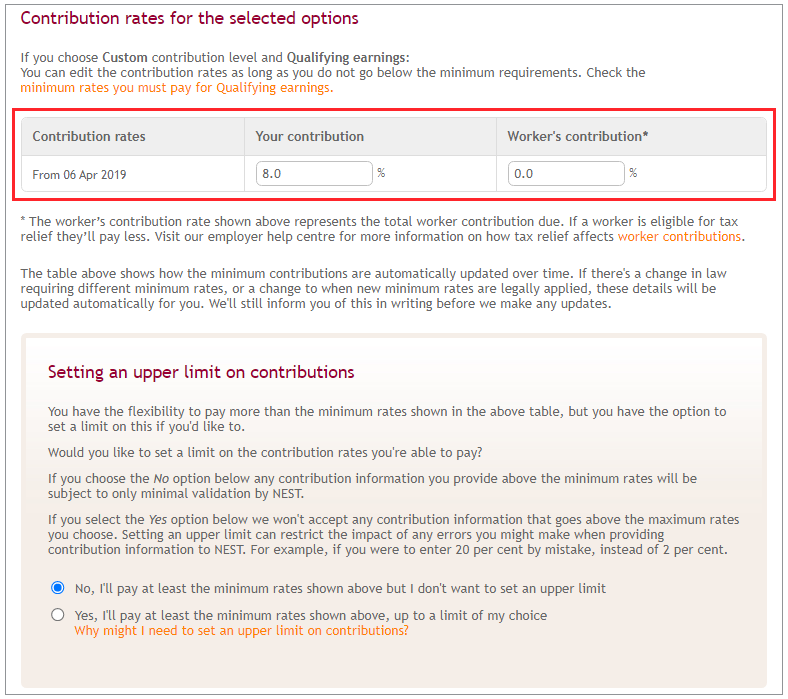

Then you’ll need to enter the total contribution rate which includes both employer and employee’s share of contribution in Your contribution box and enter zero in the Worker’s contribution box. You’ll need to ensure that ‘Setting an upper limit on contributions’ is set to ‘No, I'll pay at least the minimum rates shown above but I don’t want to set an upper limit’.

Once you’ve set up the salary sacrifice group, you’ll need to move the employees who are using salary sacrifice to it from the existing group. You can do this from the ‘Manage workers’ tab of your Nest home page. Please see How do I change a worker’s group from Manage workers? for more information.

You may need to move employees from the salary sacrifice group back to the non-salary sacrifice group or vice versa in a pay period. For example, if salary sacrifice is not used in a pay period for one or more of the employees. You can easily do this from a contribution schedule. Please see How do I submit contributions for salary sacrifice? for more information.

We value your feedback

Your feedback is important to us. To help us improve, tell us what you think about our employer help centre by taking a short survey.

Was this helpful to you?

Thank you.

Thank you.

Thank you for the feedback.

Feedback

Was this helpful to you?

Live Chat

Our live help agents will answer your questions and guide you through setting up and managing NEST.

Our chat is available from Monday to Sunday from 8.00AM to 8.00PM

Web chat is currently unavailable

We're open from 10.00 am until 4.00 pm today. Please try again between these hours or our usual business hours of 8am to 8pm Monday to Sunday. Or you can visit our online help centre.

Web chat is currently unavailable

Our offices are now closed for the Bank Holiday. You can reach us during our normal opening times of 8am to 8pm Monday to Sunday. Or you can visit our online help centre.

Welcome to live help

To help us deal with your question quickly please tell us who you are and what you'd like help with by choosing an option from each of the menus below:

Live chat

Live chat