How do I correct a schedule I’ve already paid?

We offer the flexibility for you to make changes to a paid contribution schedule as soon as the money is allocated to member’s account and the contribution schedule appears in 'Paid schedules'. If the contribution schedule is older than 23 months, it will be locked and you’ll need to send us evidence to unlock the schedule. For more information please see How do I unlock a contribution schedule for correction?

It’s important to note that after a contribution schedule has moved to ‘Paid schedules’, no changes can be made to the contribution reasons used for any partial or zero payments. In this case, you can pay the contributions by an exception schedule. For more information, please see How do I create an exception schedule?

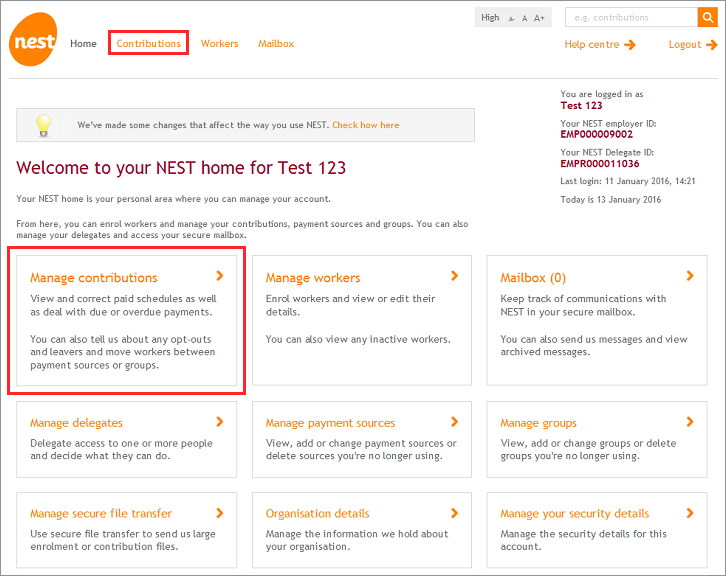

To correct a paid schedule click either ‘Contributions’ or ‘Manage contributions’ on your Nest home page.

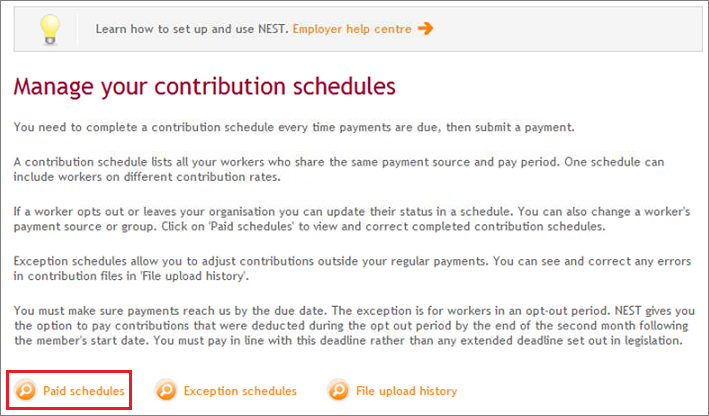

Then click ‘Paid schedules’ to find the contribution schedule you intend to correct.

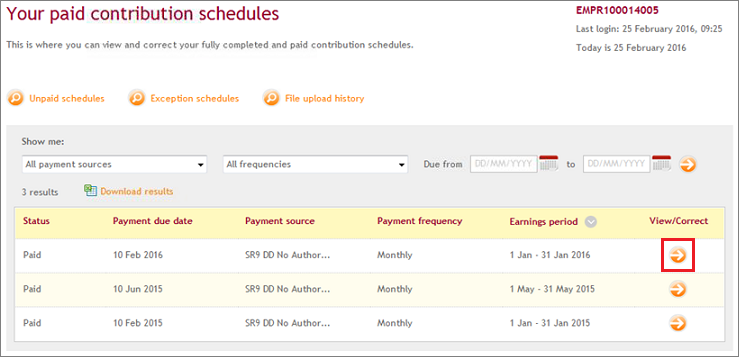

Click the arrow underneath View/Correct for the contribution schedule you wish to correct.

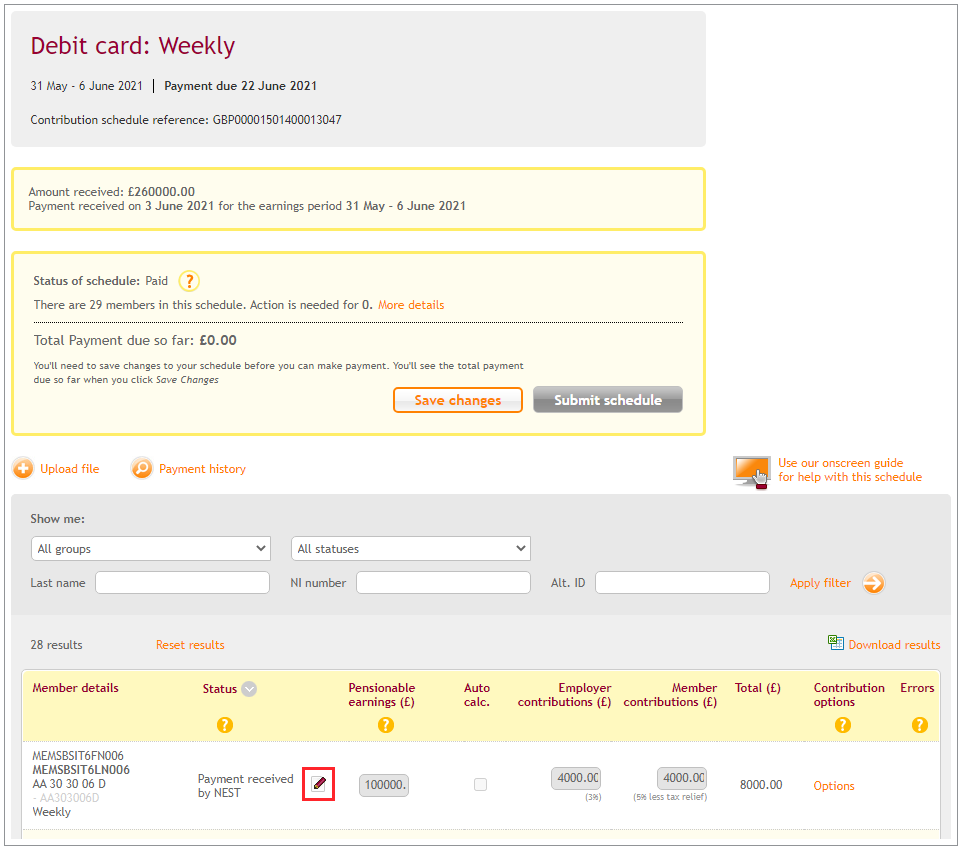

Click on the pencil icon next to the member you need to correct the contributions for.

You’ll then be able to edit the pensionable earnings, employer contributions and member contributions.

Enter the correct pensionable earnings and click ‘Auto calc’ to calculate the employer and member contributions. We’ll overwrite the amount you submitted previously and either refund the difference or request a further payment. The final amount to be refunded post correction may differ due to investment loss.

When you’ve finished making the changes click ‘Save changes’. Then click ‘Submit schedule’, even if you’re requesting a refund.

To make corrections by uploading a CSV file please see How can I correct contributions by uploading a CSV file?

We value your feedback

Your feedback is important to us. To help us improve, tell us what you think about our employer help centre by taking a short survey.

Was this helpful to you?

Thank you.

Thank you.

Thank you for the feedback.

Feedback

Was this helpful to you?

Live Chat

Our live help agents will answer your questions and guide you through setting up and managing NEST.

Our chat is available from Monday to Sunday from 8.00AM to 8.00PM

Web chat is currently unavailable

We're open from 10.00 am until 4.00 pm today. Please try again between these hours or our usual business hours of 8am to 8pm Monday to Sunday. Or you can visit our online help centre.

Web chat is currently unavailable

Our offices are now closed for the Bank Holiday. You can reach us during our normal opening times of 8am to 8pm Monday to Sunday. Or you can visit our online help centre.

Welcome to live help

To help us deal with your question quickly please tell us who you are and what you'd like help with by choosing an option from each of the menus below:

Live chat

Live chat