How do I edit a worker’s personal details?

If your active worker hasn’t logged in yet, you can edit their:

- name and title

- address

- date of birth

- gender

Once your worker has logged in, you’ll only be able to edit their:

- National Insurance number

- alternative identifier

- eligibility for UK tax relief

- Nest group

Workers will need to contact Nest on 0300 020 0090 and provide evidence, if necessary, to update their name, title, address, email address, date of birth and gender.

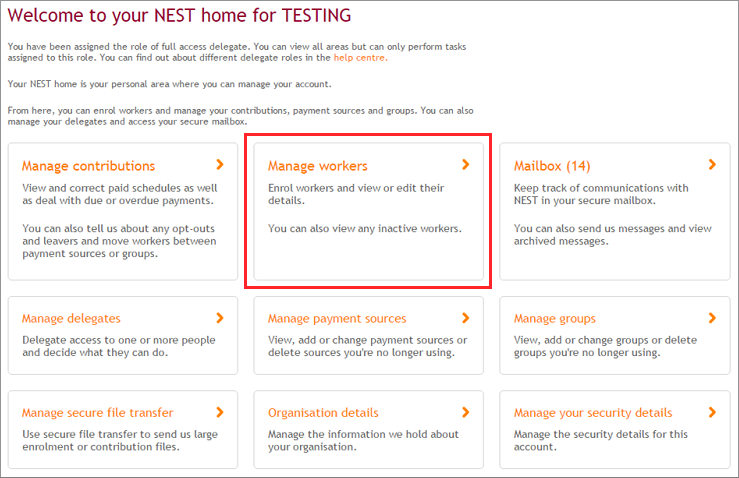

To start editing worker’s personal details, log in and click on ‘Manage workers’.

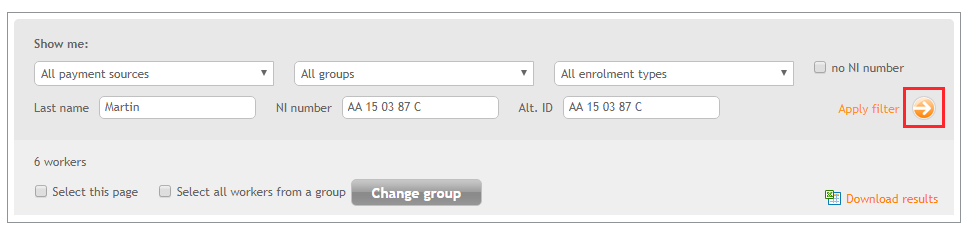

You’ll be able to see a list of workers enrolled into Nest.

If you’re looking for a particular worker, you can search for them by using the filter boxes for Last name, NI number or Alt. ID., then click on the ‘Apply filter’ arrow button.

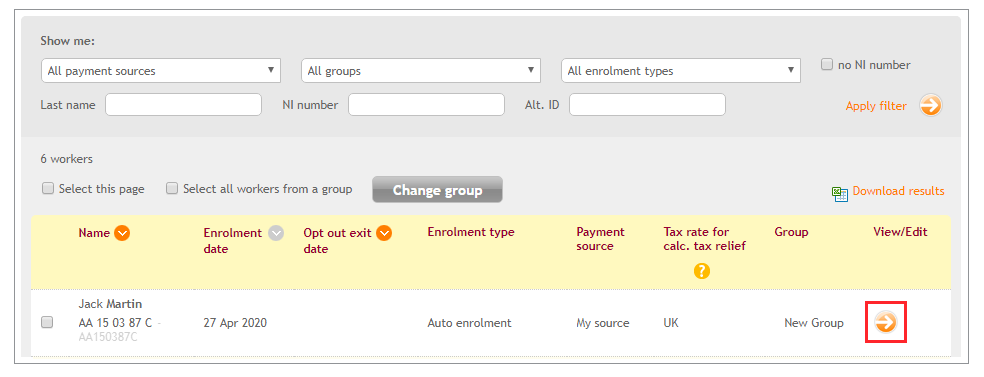

Once you’ve found them, click on the orange arrow under View/Edit.

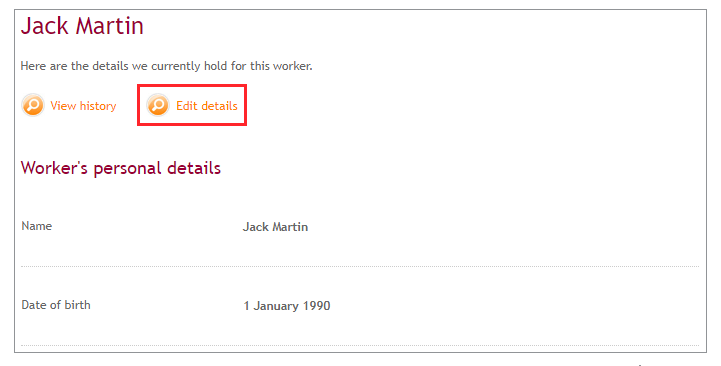

On the next page you’ll see the details we hold for the worker. Click ‘Edit details’.

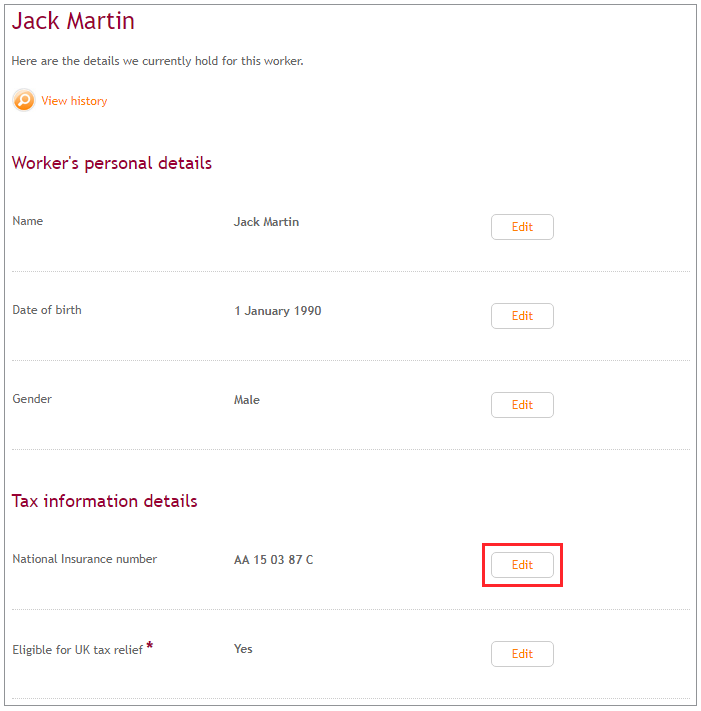

An ‘Edit’ button will appear next to the details you can change.

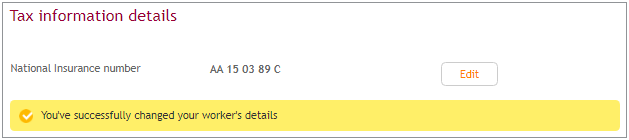

Once you’ve made the changes click ‘Save’.

Once you’ve successfully changed these details, the worker will receive a message in their secure mailbox confirming any changes made.

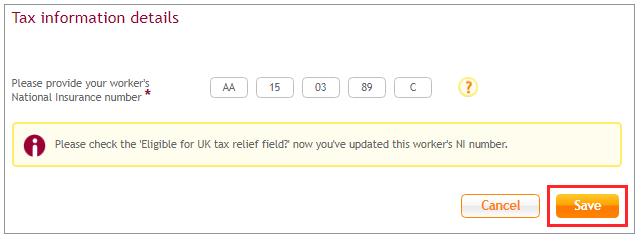

You can update the National Insurance number if it's incorrect or hasn’t been provided at the time of enrolment. If the National Insurance number is not provided at the time of enrolment, the tax eligibility status is marked as No by default, unless the worker is an overseas national waiting for NI number. If the worker is eligible for tax relief, you can change the tax eligibility status from No to Yes after updating the National Insurance number. You won’t be able to edit the tax rate for calculating tax relief. It will be automatically updated to Wales, England and N. Ireland or Scotland once we get the information from HMRC.

When you update a worker’s National Insurance number, you need to make sure it’s in the correct format. A National Insurance number has three parts – a prefix of two letters, six digits and a suffix of a single letter. For example, AB123456C. If we’ve received the correct National Insurance number from HMRC, we’ll update your worker’s record.

We value your feedback

Your feedback is important to us. To help us improve, tell us what you think about our employer help centre by taking a short survey.

Was this helpful to you?

Thank you.

Thank you.

Thank you for the feedback.

Feedback

Was this helpful to you?

Live Chat

Our live help agents will answer your questions and guide you through setting up and managing NEST.

Our chat is available from Monday to Sunday from 8.00AM to 8.00PM

Web chat is currently unavailable

We're open from 10.00 am until 4.00 pm today. Please try again between these hours or our usual business hours of 8am to 8pm Monday to Sunday. Or you can visit our online help centre.

Web chat is currently unavailable

Our offices are now closed for the Bank Holiday. You can reach us during our normal opening times of 8am to 8pm Monday to Sunday. Or you can visit our online help centre.

Welcome to live help

To help us deal with your question quickly please tell us who you are and what you'd like help with by choosing an option from each of the menus below:

Live chat

Live chat