- Member's menu

-

Close

Close - Home

- About pensions

- Your Nest pension

- Investing your pension

- Retirement

- Support

- Member's menu

-

Close

Close - Overview

- Take our three-step pension check

- Decide what kind of retirement you want

- Calculate your retirement income

- Check your pension savings are on track

- How to grow your pension

- The advantage of saving early

- Why it's never too late to save

- How lifestyle changes affect your savings

- Member's menu

-

Close

Close

- Support

- Help centre

- Contact us

Working for change

together

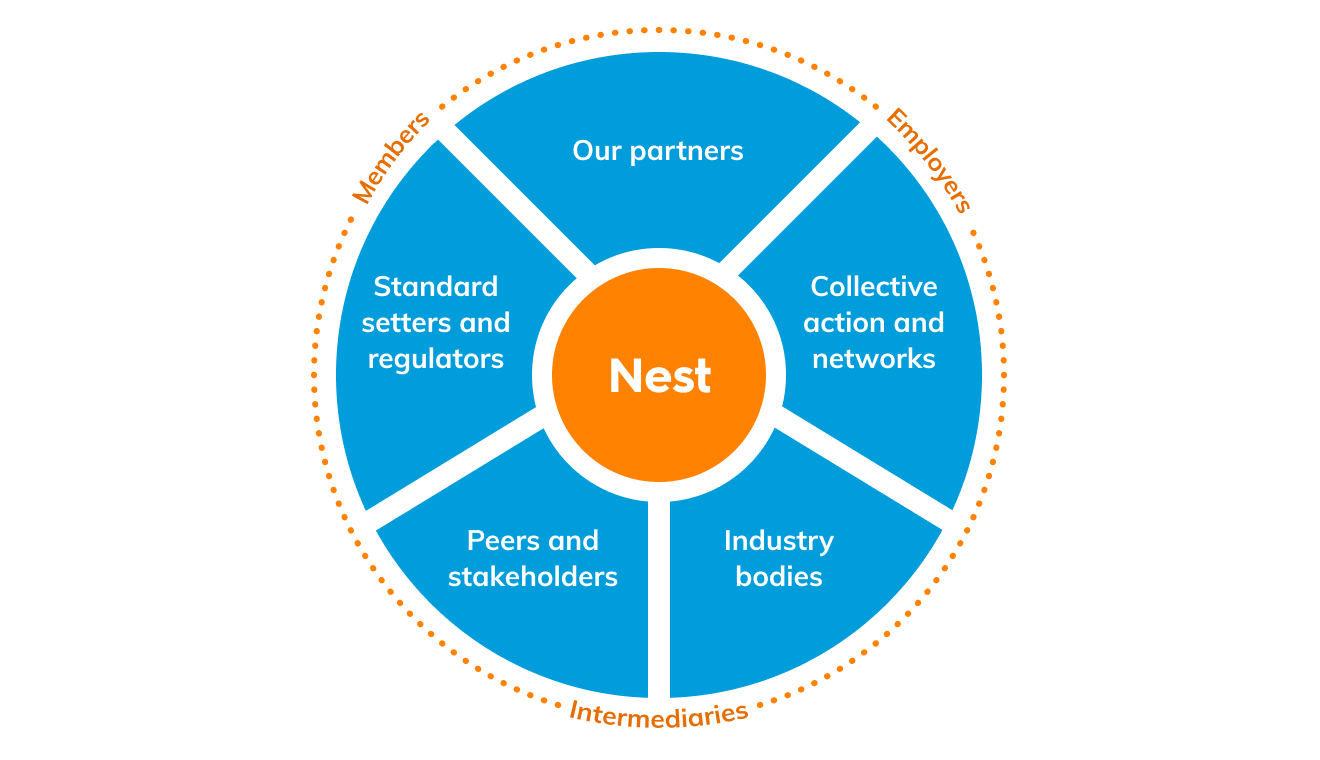

Maintaining relationships with others allows Nest to share resources and knowledge.

To achieve positive change across our investments, and the markets and regulatory environments in which we operate, we work together with regulators, key stakeholders, partners and other organisations. This allows us to exert stronger influence and speak with one voice. So that we can be more effective when acting on issues that matter to our members.

Here are just a few of the organisations we work with to drive positive change:

We're signatories to the UK Stewardship Code which includes 12 principles that promote the management and oversight of capital to create long-term value for clients and beneficiaries, leading to sustainable benefits for the economy, environment and society. As part of Nest’s commitment to the code we set out how we adhere to the 12 principles in our annual responsible investment report (PDF). We regularly engage with the Financial Reporting Council (FRC) on issues of UK Corporate Governance and stewardship and are members of the climate and workforce reporting working group.

Nest’s a proud member of the 30% Club investor group. This is a movement that believes that 30 per cent is a reasonable initial target for representation of women on corporate boards. Evidence and analysis from diverse fields, such as organisational dynamics, social psychology and traditional financial analysis suggests that 30 per cent is where the contributions of a ‘minority’ group become valued. The 30% club will use its members' combined power to demonstrate use of their ownership rights and undertake engagement with policy makers to encourage progress on gender diversity.

Nest is a founding signatory to ShareAction’s Workforce Disclosure Initiative (WDI). This is a project seeking to improve company disclosure on how companies manage workers they directly employ and people working in their supply chains. We’ve helped ShareAction launch its inaugural WDI survey, which targets large globally listed employers. The survey aims to bring together key questions from mandatory reporting standards and voluntary reporting frameworks into a single consolidated survey.

Being part of the Institutional Investors Group on Climate Change (IIGCC) keeps Nest updated on the developments in EU and international climate and energy policy. It also supports our work on climate risk and engagement. We're currently involved in a number of IIGCC workstreams including ClimateAction 100+, the Paris-Aligned Investment Initiative.

The Task Force on Climate-related Financial Disclosures (TCFD) is a climate reporting framework spearheaded by former Financial Stability Board chairman and Bank of England Governor Mark Carney. It encourages all organisations, including financial sector organisations, to publicly disclose climate-related financial information so that investors and stakeholders can better understand the climate-related risks and opportunities they face.

Our partnership with our proxy voting agent Minerva Analytics is instrumental to our voting process. Minerva help us develop voting policies that are progressive and aligned with our views on issues like diversity, climate change and audit. They also help us oversee how our fund managers are voting our shares and flag issues for discussion ahead of AGMs.

We support good corporate behaviour by working with regulators and standard setters. Better standards across markets mean our members can benefit from higher standards in all the companies we invest in on their behalf. We’ve engaged with regulators including the Financial Conduct Authority (FCA), Financial Reporting Council (FRC), the Department for Business, Energy and Industrial Strategy (BEIS) and the Department for Work and Pensions (DWP).

See how we've engaged and responded to their consultations.

The Tobacco-Free Finance Pledge is part of the Tobacco Free Portfolios initiative. It works collaboratively with finance leaders spanning banking, insurance, pension funds, sovereign wealth funds, asset management and rating agencies, with a goal of putting tobacco-free finance on the agenda across the world. The Tobacco-Free Finance Pledge highlights the leadership of financial institutions that have implemented tobacco-free finance policies and encourages others to follow suit.

We signed up to the pledge in 2019 and removed all tobacco investments from our portfolio by 2020.

These are the tobacco companies excluded from Nest's investment universe:

- Altria Group Inc

- British American Tobacco PLC

- Canopy Growth Corp

- Eastern Co SAE

- Gudang Garam Tbk PT

- HM Sampoerna Tbk PT

- Imperial Brands PLC

- ITC Ltd

- Japan Tobacco Inc

- KT&G Corp

- Philip Morris International Inc

- Shandong Sun Paper INDUSTR-A

- Shanghai Industrial HLDG LTD

- Swedish Match AB

- Vector Group

- Yunnan Energy New MATERIAL-A